Understanding Lifetime Customer Value sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Get ready to dive into the world of customer value and how it can revolutionize business strategies.

Introduction to Lifetime Customer Value: Understanding Lifetime Customer Value

Lifetime Customer Value (LCV) is the total amount of revenue a business can expect to earn from a customer throughout their entire relationship with the company.

Understanding LCV is crucial for businesses because it helps them make informed decisions about how much to invest in acquiring and retaining customers. By knowing the value each customer brings over their lifetime, companies can allocate resources more effectively and tailor their marketing strategies to maximize profitability.

Examples of How LCV Impacts Business Decisions

- Companies with a high LCV may be willing to spend more on customer acquisition because they know they will recoup the cost over time through repeat purchases.

- Businesses can use LCV to identify their most valuable customers and focus on retaining them through loyalty programs or personalized marketing efforts.

- Understanding LCV can also help companies set pricing strategies based on the long-term value customers bring, rather than just focusing on short-term profits.

Factors Influencing Lifetime Customer Value

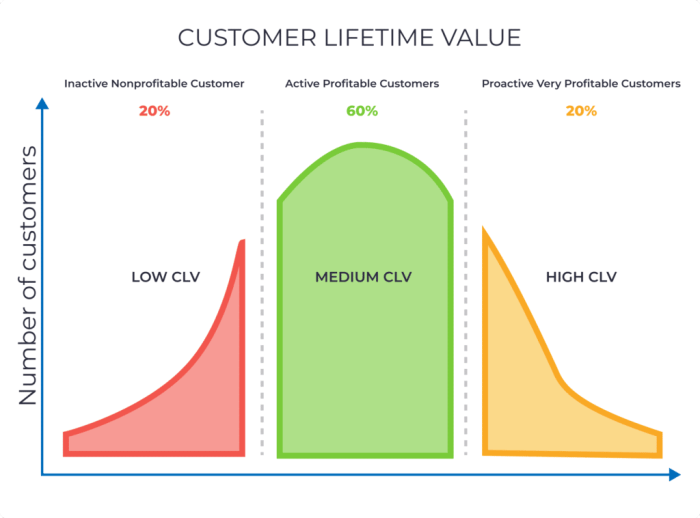

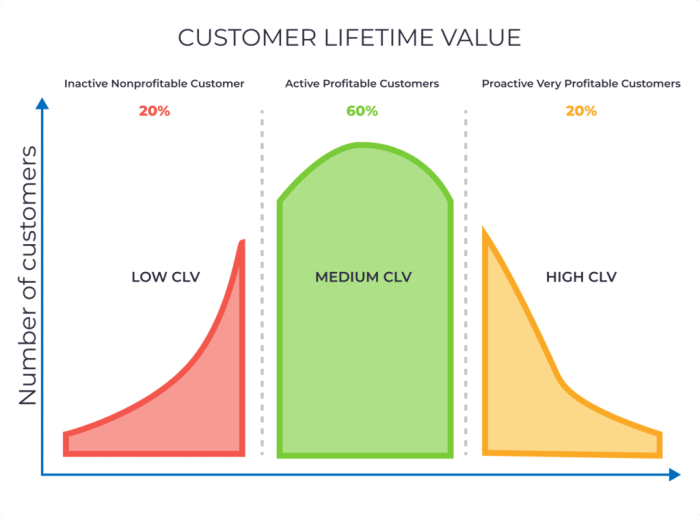

When it comes to understanding Lifetime Customer Value (LCV), there are several key factors that play a crucial role in determining the value a customer brings to a business over their entire relationship. Customer behavior, purchasing patterns, and segmentation are all significant influencers of LCV.

Customer Behavior and Purchasing Patterns

Customer behavior and purchasing patterns have a direct impact on Lifetime Customer Value. For example, customers who make frequent purchases, buy higher-priced items, or remain loyal to a brand over an extended period tend to have a higher LCV. On the other hand, customers who make one-time purchases or show inconsistent buying behavior may have a lower LCV. Understanding how different customer segments behave and make purchasing decisions is essential for businesses to tailor their strategies and maximize LCV.

Customer Segmentation

Customer segmentation involves dividing customers into groups based on similar characteristics, such as demographics, behaviors, or preferences. This segmentation can significantly impact LCV calculations by allowing businesses to target specific customer segments with tailored marketing messages, promotions, and offers. By identifying high-value customer segments and focusing efforts on retaining and upselling to these customers, businesses can increase their overall LCV and drive long-term profitability.

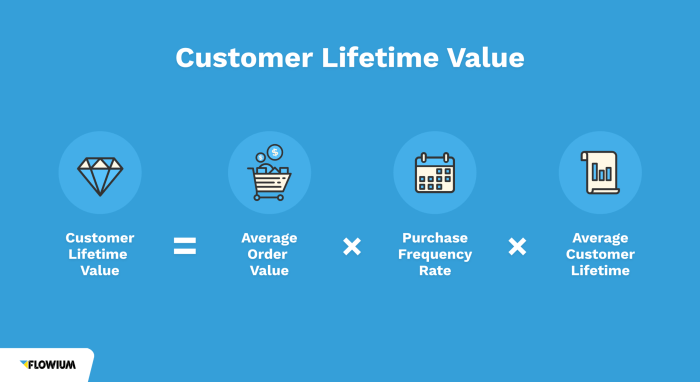

Calculating Lifetime Customer Value

Calculating Lifetime Customer Value (LCV) is crucial for businesses to understand the long-term value of each customer. By determining how much revenue a customer is expected to generate over their entire relationship with a company, businesses can make informed decisions regarding marketing strategies, customer retention efforts, and overall profitability.

Different Methods for Calculating LCV

- Historical LCV Calculation: This method involves analyzing past customer behavior and purchase history to predict future spending patterns.

- Predictive Analytics: Utilizing advanced data analysis techniques to forecast future customer value based on various factors such as demographics, purchase frequency, and engagement levels.

- Cohort Analysis: Segmenting customers into groups based on similar characteristics and analyzing their lifetime value within each cohort.

Compare and Contrast Traditional LCV Calculation Approaches

- Traditional LCV Calculation: Focuses on historical data and averages to estimate customer value over time.

- Advanced LCV Calculation: Incorporates predictive modeling and personalized customer insights to provide more accurate and dynamic LCV calculations.

- Simple LCV Calculation: Uses basic formulas to calculate average customer value without considering individual customer nuances.

Importance of Accurate Data in LCV Calculations

Accurate data is essential for calculating Lifetime Customer Value as it directly impacts the precision and reliability of the results. Without reliable data on customer behavior, purchase history, and engagement metrics, businesses may miscalculate LCV and make misguided decisions. By ensuring data accuracy and consistency, companies can enhance their understanding of customer value and tailor their strategies accordingly.

Improving Lifetime Customer Value

Increasing the Lifetime Customer Value (LCV) of your customers is crucial for long-term business success. By implementing effective strategies and customer retention programs, you can enhance LCV and maximize profitability.

Implementing Personalized Marketing Campaigns

Personalized marketing campaigns tailored to individual customer preferences and behaviors can significantly increase LCV. By sending targeted promotions, recommendations, and exclusive offers based on customer data, you can build stronger relationships and encourage repeat purchases.

Enhancing Customer Experience

Providing exceptional customer service and a seamless shopping experience can lead to higher customer satisfaction and loyalty. By investing in user-friendly websites, quick response times, and efficient problem resolution, you can retain customers for the long term and increase their lifetime value.

Offering Loyalty Programs

Loyalty programs incentivize customers to make repeat purchases by offering rewards, discounts, and exclusive perks. By implementing a tiered loyalty program that rewards customers based on their level of engagement, you can encourage loyalty and increase LCV.

Utilizing Data Analytics

Analyzing customer data and behavior patterns can provide valuable insights into customer preferences, buying habits, and lifetime value. By leveraging data analytics tools to segment customers, personalize marketing efforts, and predict future purchasing behaviors, you can optimize your strategies to maximize LCV.

Building Strong Relationships, Understanding Lifetime Customer Value

Fostering strong relationships with customers through personalized communication, follow-ups, and engagement can increase trust and loyalty. By staying connected with customers through email marketing, social media interactions, and personalized recommendations, you can enhance LCV and turn one-time buyers into loyal advocates.