Arsitek interior profesional adalah sosok kunci dalam menciptakan ruang yang tidak hanya indah tetapi juga fungsional. Dengan keahlian dan kreativitas mereka, setiap sudut ruangan dapat diubah menjadi tempat yang nyaman, menarik, dan sesuai kebutuhan penghuninya.

Dalam dunia desain interior, arsitek profesional tidak hanya bertugas merancang estetika ruang, tetapi juga meningkatkan kualitas hidup penghuninya. Melalui pemahaman mendalam tentang prinsip desain, mereka mampu menghadirkan solusi kreatif yang menjawab berbagai tantangan, menjadikan setiap proyek desain unik dan bernilai tinggi.

Pentingnya peran arsitek interior profesional dalam desain ruang

Arsitek interior profesional memiliki peran krusial dalam menciptakan ruang yang tidak hanya menarik secara visual, tetapi juga fungsional dan nyaman bagi penghuninya. Mereka memiliki keahlian dalam memadukan estetika dengan kebutuhan praktis, sehingga setiap sudut dari ruang dapat dimaksimalkan. Melalui pemahaman mendalam tentang bahan, pencahayaan, dan tata letak, arsitek interior dapat menciptakan suasana yang mendukung aktivitas sehari-hari serta meningkatkan kualitas hidup penghuninya.

Salah satu contoh nyata dari kontribusi arsitek interior adalah proyek desain interior di sebuah kantor yang berlokasi di pusat kota Jakarta. Dalam proyek tersebut, arsitek interior berhasil mengubah ruang kerja yang awalnya monoton menjadi lingkungan yang inspiratif dan produktif. Dengan menggunakan warna yang cerah, furniture yang ergonomis, dan pembagian ruang yang efisien, karyawan merasakan peningkatan semangat kerja dan kreativitas. Mereka tidak hanya merasa lebih nyaman, tetapi juga lebih termotivasi untuk berkolaborasi dan berinovasi. Hal ini menunjukkan bahwa desain interior yang baik dapat berdampak positif terhadap produktivitas.

Dampak desain interior terhadap kesejahteraan penghuni dan produktivitas di ruang kerja

Desain interior yang baik tidak hanya membuat suatu ruang terlihat menarik, tetapi juga memiliki dampak besar terhadap kesejahteraan penghuni. Beberapa faktor yang mempengaruhi ini antara lain:

- Pencahayaan yang baik: Pencahayaan alami yang cukup dapat meningkatkan suasana hati dan energi, sedangkan pencahayaan buatan yang tepat dapat mengurangi kelelahan mata.

- Penggunaan warna: Warna dapat mempengaruhi emosi. Misalnya, warna biru menenangkan sedangkan warna merah dapat meningkatkan semangat.

- Furniture ergonomis: Memilih furniture yang nyaman dan sesuai dengan postur tubuh dapat mencegah masalah kesehatan jangka panjang dan meningkatkan kenyamanan saat bekerja.

- Ruang terbuka hijau: Kehadiran tanaman dalam ruang kerja dapat mengurangi stres dan meningkatkan konsentrasi, menciptakan suasana yang lebih segar.

Ruang kerja yang dirancang dengan mempertimbangkan aspek-aspek tersebut tidak hanya memberikan kenyamanan, tetapi juga berkontribusi pada kestabilan emosional dan kesehatan mental para penghuninya. Oleh karena itu, peran arsitek interior profesional sangat penting dalam menciptakan lingkungan yang mendukung kesejahteraan dan produktivitas.

Proses kerja arsitek interior profesional dari konsep hingga realisasi

Arsitek interior profesional memiliki peran penting dalam menciptakan ruang yang tidak hanya estetis tetapi juga fungsional. Proses kerja mereka melibatkan berbagai langkah yang dimulai dari pengumpulan kebutuhan klien hingga penyelesaian proyek. Setiap detail diperhatikan untuk memastikan bahwa hasil akhir sesuai dengan harapan klien dan memenuhi standar kualitas. Mari kita bahas langkah-langkah utama dalam proses desain interior ini.

Langkah-langkah dalam Proses Desain Interior

Proses desain interior yang dilakukan oleh arsitek profesional biasanya mencakup beberapa tahapan yang terstruktur. Berikut adalah langkah-langkah utama yang biasanya diikuti:

- Pengumpulan Kebutuhan Klien: Di tahap ini, arsitek interior berinteraksi langsung dengan klien untuk memahami kebutuhan dan preferensi mereka, termasuk gaya, fungsi, dan anggaran.

- Pembuatan Konsep Desain: Setelah memahami kebutuhan klien, arsitek mulai merancang konsep desain awal. Ini bisa berupa sketsa, mood board, atau representasi visual lainnya yang menggambarkan visi awal.

- Pengembangan Desain: Tahap ini meliputi penyempurnaan konsep, memilih material, warna, dan elemen desain lainnya. Arsitek juga akan membuat gambar kerja yang lebih detail.

- Kolaborasi dengan Kontraktor: Setelah desain disetujui, arsitek akan bekerja sama dengan kontraktor untuk memastikan bahwa rencana dapat direalisasikan sesuai spesifikasi yang diberikan.

- Pengawasan Proyek: Arsitek interior harus memastikan bahwa proyek berjalan sesuai rencana. Ini termasuk melakukan inspeksi rutin dan berkomunikasi dengan semua pihak terkait.

- Penyelesaian Proyek: Setelah semua elemen terpasang dengan baik, arsitek melakukan evaluasi akhir untuk memastikan semua detail telah sesuai dengan rencana dan memenuhi harapan klien.

Kolaborasi dengan Kontraktor dan Pemasok Material

Kolaborasi antara arsitek interior, kontraktor, dan pemasok material sangat krusial dalam memastikan hasil akhir yang optimal. Arsitek berfungsi sebagai penghubung antara klien dan tim pelaksana. Melalui komunikasi yang baik, mereka dapat memastikan bahwa setiap elemen yang dirancang dapat diproduksi dan dipasang dengan benar. Proses ini meliputi:

- Rapat Koordinasi: Mengadakan pertemuan rutin dengan kontraktor dan pemasok untuk membahas kemajuan dan mengatasi masalah yang muncul.

- Pemilihan Material: Memilih material yang sesuai dengan desain dan anggaran, serta memastikan ketersediaannya dari pemasok.

- Pengawasan Kualitas: Memastikan bahwa semua pemasangan dilakukan dengan standar tinggi dan sesuai dengan spesifikasi desain.

Timeline Proyek Desain Interior

Untuk memberikan gambaran yang lebih jelas tentang waktu yang diperlukan dalam setiap fase, berikut adalah tabel yang menunjukkan estimasi waktu untuk setiap bagian dari proyek desain interior:

| Fase Proyek | Estimasi Waktu |

|---|---|

| Pengumpulan Kebutuhan Klien | 1-2 minggu |

| Pembuatan Konsep Desain | 2-3 minggu |

| Pengembangan Desain | 3-4 minggu |

| Kolaborasi dengan Kontraktor | 1-2 minggu |

| Pengawasan Proyek | Berlangsung selama proyek |

| Penyelesaian Proyek | 1 minggu |

Tren terkini dalam desain interior oleh arsitek profesional

Desain interior saat ini tidak hanya sekadar mengenai estetika, tetapi juga mencerminkan gaya hidup dan nilai-nilai yang berkembang di masyarakat. Arsitek profesional semakin beradaptasi dengan tren yang tidak hanya menarik secara visual, tetapi juga fungsional dan berkelanjutan. Dalam artikel ini, kita akan membahas beberapa tren terkini dalam desain interior yang populer di kalangan arsitek, serta elemen-elemen desain yang mendukung perubahan gaya hidup saat ini.

Pergeseran ke arah desain yang berkelanjutan

Desain interior yang ramah lingkungan menjadi salah satu fokus utama arsitek profesional. Hal ini mencerminkan kesadaran yang semakin tinggi akan pentingnya keberlanjutan dalam setiap aspek kehidupan. Material yang digunakan dalam desain interior kini banyak yang berasal dari sumber yang dapat diperbarui dan memiliki jejak karbon yang rendah. Berikut adalah beberapa elemen yang sedang populer:

- Penggunaan material daur ulang seperti kayu bekas dan logam daur ulang yang tidak hanya ramah lingkungan tetapi juga memberikan karakter unik pada ruang.

- Penggunaan cat dan finishing yang bebas dari bahan kimia berbahaya, sehingga menciptakan lingkungan yang lebih sehat bagi penghuninya.

- Penanaman elemen hijau dalam desain, seperti taman vertikal atau penggunaan tanaman hias yang dapat meningkatkan kualitas udara di dalam ruangan.

Warna yang mencerminkan kenyamanan dan ketenangan

Warna juga memainkan peran penting dalam menciptakan suasana yang diinginkan dalam suatu ruang. Tren terkini menunjukkan pergeseran menuju palet warna yang lebih lembut dan netral, yang menciptakan rasa tenang dan nyaman. Arsitek sering memanfaatkan warna-warna seperti biru lembut, hijau sage, dan beige hangat untuk memberikan nuansa yang menenangkan.

Integrasi teknologi pintar dalam desain interior

Teknologi pintar kini menjadi bagian integral dari desain interior modern. Arsitek profesional tidak hanya merancang ruang, tetapi juga mempertimbangkan bagaimana teknologi dapat meningkatkan pengalaman pengguna. Beberapa contoh integrasi teknologi pintar meliputi:

- Sistem pencahayaan yang dapat diatur melalui smartphone, memungkinkan penghuni untuk menciptakan suasana yang diinginkan dengan mudah.

- Perangkat rumah pintar seperti termostat cerdas dan sistem keamanan yang terintegrasi dalam desain tanpa mengganggu estetika.

- Penggunaan tirai otomatis yang dapat diatur untuk menyesuaikan cahaya alami yang masuk, meningkatkan efisiensi energi.

Contoh visual tren desain interior yang berkembang

Beberapa desain interior yang sedang berkembang saat ini bisa dilihat dalam berbagai proyek yang dilakukan oleh arsitek ternama. Misalnya, penggunaan open space yang didominasi oleh material alami dan aksen warna yang lembut, menciptakan ruang yang terasa lebih luas dan nyaman. Dalam banyak kasus, elemen-elemen seperti furnitur multi-fungsi dan penyimpanan yang tersembunyi menjadi pilihan utama, sehingga ruang tetap rapi dan terorganisir.

Arsitek juga sering menggabungkan elemen tradisional dengan sentuhan modern, seperti pencahayaan desain yang unik atau karya seni lokal yang memberikan karakter pada ruang. Misalnya, ruang tamu yang menggabungkan sofa kontemporer dengan meja kayu tradisional bisa menciptakan keseimbangan yang menarik.

Dengan memahami tren dan elemen yang sedang berkembang dalam desain interior, arsitek profesional dapat menciptakan ruang yang tidak hanya menarik secara visual tetapi juga sesuai dengan kebutuhan dan nilai-nilai penghuninya.

Tantangan yang dihadapi arsitek interior profesional dan solusinya

Arsitektur interior adalah bidang yang menuntut kreativitas tinggi, tetapi juga menghadapi berbagai tantangan yang dapat memengaruhi hasil akhir proyek. Dalam setiap proyek, arsitek interior profesional harus mampu menghadapi sejumlah rintangan, mulai dari keterbatasan anggaran hingga ruang yang terbatas. Memahami tantangan-tantangan ini dan memiliki strategi untuk mengatasinya sangat penting agar proses desain berjalan lancar dan hasilnya memuaskan.

Salah satu tantangan yang sering muncul adalah anggaran yang terbatas. Banyak klien memiliki batasan finansial yang ketat, yang dapat membatasi pilihan material dan desain. Selain itu, keterbatasan ruang juga menjadi masalah di lingkungan perkotaan, di mana ruang sudah menjadi barang mewah. Hal ini mengharuskan arsitek untuk berpikir kreatif dan inovatif dalam memaksimalkan setiap inci ruang yang ada.

Anggaran Terbatas dan Pendekatannya

Anggaran yang ketat dapat membuat pekerjaan arsitek interior terasa menantang. Namun, ada beberapa strategi yang dapat diterapkan untuk mengatasi masalah ini. Salah satunya adalah dengan melakukan prioritas pada elemen desain yang paling penting dan mencari alternatif material yang lebih terjangkau namun tetap berkualitas.

- Melakukan riset mendalam terhadap material dan suplai yang memiliki harga lebih terjangkau.

- Memprioritaskan elemen desain yang paling berdampak untuk ditonjolkan.

- Menggunakan furnishings yang multifungsi untuk menghemat biaya dan ruang.

- Menciptakan desain yang dapat diperbarui secara bertahap sesuai dengan anggaran klien.

Keterbatasan Ruang dan Solusinya

Keterbatasan ruang adalah tantangan umum lainnya yang dihadapi oleh arsitek interior, terutama di area perkotaan. Menghadapi masalah ini menuntut pemikiran yang inovatif dan pemanfaatan desain yang cerdas untuk menciptakan ruang yang nyaman dan fungsional.

- Menggunakan furnitur yang dapat dilipat atau disimpan untuk mengoptimalkan ruang saat tidak digunakan.

- Memanfaatkan cermin untuk menciptakan ilusi ruang yang lebih besar.

- Memilih warna-warna cerah yang dapat membuat ruangan terasa lebih luas.

- Menerapkan desain terbuka yang menggabungkan berbagai fungsi dalam satu area.

Penerapan Solusi Kreatif

Menghadapi tantangan yang ada memerlukan pendekatan yang kreatif. Berikut adalah beberapa solusi kreatif yang dapat diterapkan oleh arsitek interior untuk mengatasi berbagai kendala:

- Mengintegrasikan teknologi pintar yang membantu dalam efisiensi ruang dan pengelolaan anggaran.

- Berkolaborasi dengan kontraktor dan pemasok untuk mendapatkan penawaran terbaik.

- Menjajaki opsi desain yang ramah lingkungan untuk material dan furnitur, yang sering kali menawarkan efisiensi biaya jangka panjang.

- Mengadopsi gaya minimalis, yang dapat mengurangi biaya sambil tetap menciptakan estetika yang menarik.

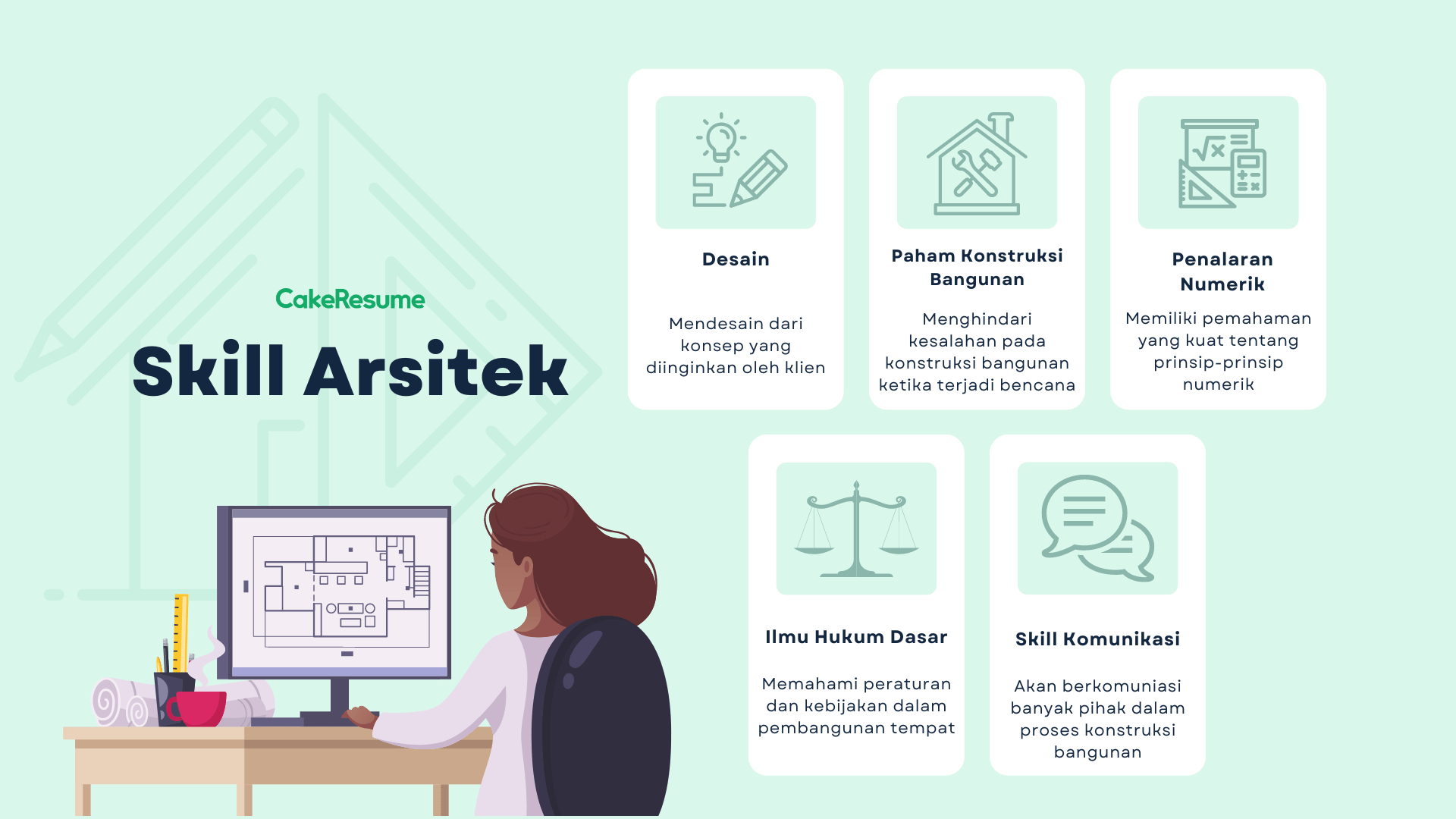

Kualifikasi dan keahlian yang dibutuhkan untuk menjadi arsitek interior profesional

Menjadi arsitek interior profesional bukan hanya tentang memiliki selera desain yang baik, tetapi juga memerlukan berbagai kualifikasi dan keahlian yang mendalam. Profesi ini mengharuskan seseorang untuk mengintegrasikan pengetahuan teknis dengan kreativitas, serta tidak kalah pentingnya adalah kemampuan berkomunikasi dan manajemen proyek yang mumpuni. Mari kita simak lebih dalam mengenai kualifikasi dan keahlian yang dibutuhkan untuk sukses di dunia arsitektur interior.

Kualifikasi pendidikan dan pelatihan

Untuk menjadi arsitek interior yang sukses, pendidikan formal adalah langkah awal yang sangat penting. Sebagian besar arsitek interior memiliki gelar sarjana di bidang desain interior atau arsitektur. Pendidikan ini tidak hanya mencakup teori desain, tetapi juga teknik menggambar, pemahaman tentang material, serta aspek fungsional dari ruang. Program-program ini biasanya mencakup praktik langsung yang memberikan pengalaman berharga.

Setelah menyelesaikan pendidikan formal, penting untuk mengikuti pelatihan tambahan melalui magang atau posisi entry-level di studio desain. Pengalaman langsung ini sangat berguna untuk memahami dinamika proyek dan bekerja dengan klien serta kontraktor. Selain itu, beberapa arsitek interior memilih untuk mendapatkan sertifikasi profesional, seperti dari Asosiasi Desainer Interior, yang bisa meningkatkan kredibilitas dan kemampuan bersaing di pasar.

Pentingnya keterampilan komunikasi dan manajemen proyek

Keterampilan komunikasi yang baik sangat penting dalam profesi ini. Arsitek interior harus mampu menyampaikan ide dan konsep desain kepada klien dengan jelas, serta menjelaskan langkah-langkah teknis kepada tim proyek yang terlibat. Tidak jarang, mereka juga harus mendengarkan kebutuhan klien dengan seksama untuk menghasilkan desain yang sesuai harapan.

Selain itu, manajemen proyek menjadi kunci untuk menjaga agar semua aspek proyek berjalan sesuai rencana. Ini termasuk pengelolaan waktu, anggaran, dan sumber daya. Arsitek interior perlu dapat mengoordinasikan berbagai pihak, mulai dari pemasok material hingga pekerja lapangan, agar proyek dapat diselesaikan dengan sukses dan tepat waktu.

Kegiatan pengembangan profesional

Untuk terus berkembang dalam bidang desain interior, arsitek profesional harus aktif dalam pengembangan keterampilan mereka. Beberapa kegiatan yang dapat diikuti antara lain:

- Workshop dan seminar: Mengikuti workshop atau seminar tentang tren terbaru dalam desain interior akan membantu arsitek interior untuk terus memperbarui pengetahuannya.

- Kursus online: Banyak platform menawarkan kursus online mengenai software desain, manajemen proyek, dan aspek teknis lainnya yang berkaitan dengan arsitektur interior.

- Konferensi industri: Menghadiri konferensi memungkinkan arsitek untuk berjejaring dengan profesional lain dan mendapatkan wawasan baru tentang praktik terbaik dalam industri.

Dengan terus berinvestasi dalam pengembangan diri, arsitek interior bisa tetap relevan dan kompetitif di pasar yang selalu berubah. Setiap langkah yang diambil untuk meningkatkan keterampilan tidak hanya bermanfaat bagi karier individu, tetapi juga meningkatkan kualitas layanan yang dapat diberikan kepada klien.

Simpulan Akhir

Secara keseluruhan, peran arsitek interior profesional sangat penting dalam menciptakan lingkungan yang mendukung kesejahteraan dan produktivitas. Dengan pengetahuan dan keterampilan yang terus berkembang, mereka mampu menghadirkan tren dan inovasi dalam desain, menjadikan setiap ruang sebagai cerminan gaya hidup yang lebih baik.

Jawaban yang Berguna

Apa yang dilakukan arsitek interior profesional?

Arsitek interior profesional merancang, merencanakan, dan mendesain ruang interior untuk memenuhi kebutuhan dan keinginan klien.

Apa bedanya arsitek interior dengan desainer interior?

Arsitek interior biasanya memiliki pendidikan dan lisensi yang lebih formal dibandingkan desainer interior, serta dapat menangani proyek yang lebih kompleks.

Berapa biaya jasa arsitek interior profesional?

Biaya dapat bervariasi tergantung pada pengalaman, lokasi, dan kompleksitas proyek, tetapi biasanya dihitung berdasarkan persentase dari total biaya proyek atau biaya per jam.

Bagaimana cara memilih arsitek interior yang tepat?

Pilih arsitek interior berdasarkan portofolio, testimoni klien sebelumnya, dan kemampuan mereka untuk memahami kebutuhan Anda.

Apakah arsitek interior juga mengurus perizinan bangunan?

Ya, arsitek interior sering kali juga mengurus perizinan yang diperlukan untuk proyek desain interior, tergantung pada peraturan setempat.