Budgeting for Families dives into the world of managing finances, offering a fresh perspective that resonates with families looking to secure their financial future. From setting realistic goals to exploring effective budgeting methods, this topic covers it all.

Importance of Budgeting for Families

Budgeting is crucial for families as it helps them manage their finances effectively, plan for the future, and achieve their financial goals. By creating a budget, families can track their income and expenses, identify areas where they can save money, and make informed financial decisions.

Benefits of Effective Budgeting in Family Finances

- Helps families prioritize spending and allocate funds to essentials like housing, food, and healthcare.

- Reduces financial stress and uncertainty by providing a clear roadmap for managing money.

- Enables families to save for emergencies, education, retirement, and other long-term goals.

- Encourages communication and teamwork within the family to work towards common financial objectives.

Examples of How Budgeting Can Help Families Achieve Their Financial Goals

- Setting a monthly budget for groceries and dining out can help a family save money and reduce unnecessary expenses.

- Creating a savings plan for a family vacation can make it more achievable and enjoyable without going into debt.

- Tracking expenses and income can help a family understand where their money is going and make adjustments to reach their savings goals faster.

Creating a Family Budget

Creating a family budget is essential for managing finances effectively and ensuring financial stability. It involves several key steps to help families track their income, expenses, and savings. By following these steps, families can set realistic financial goals and make informed decisions about their money.

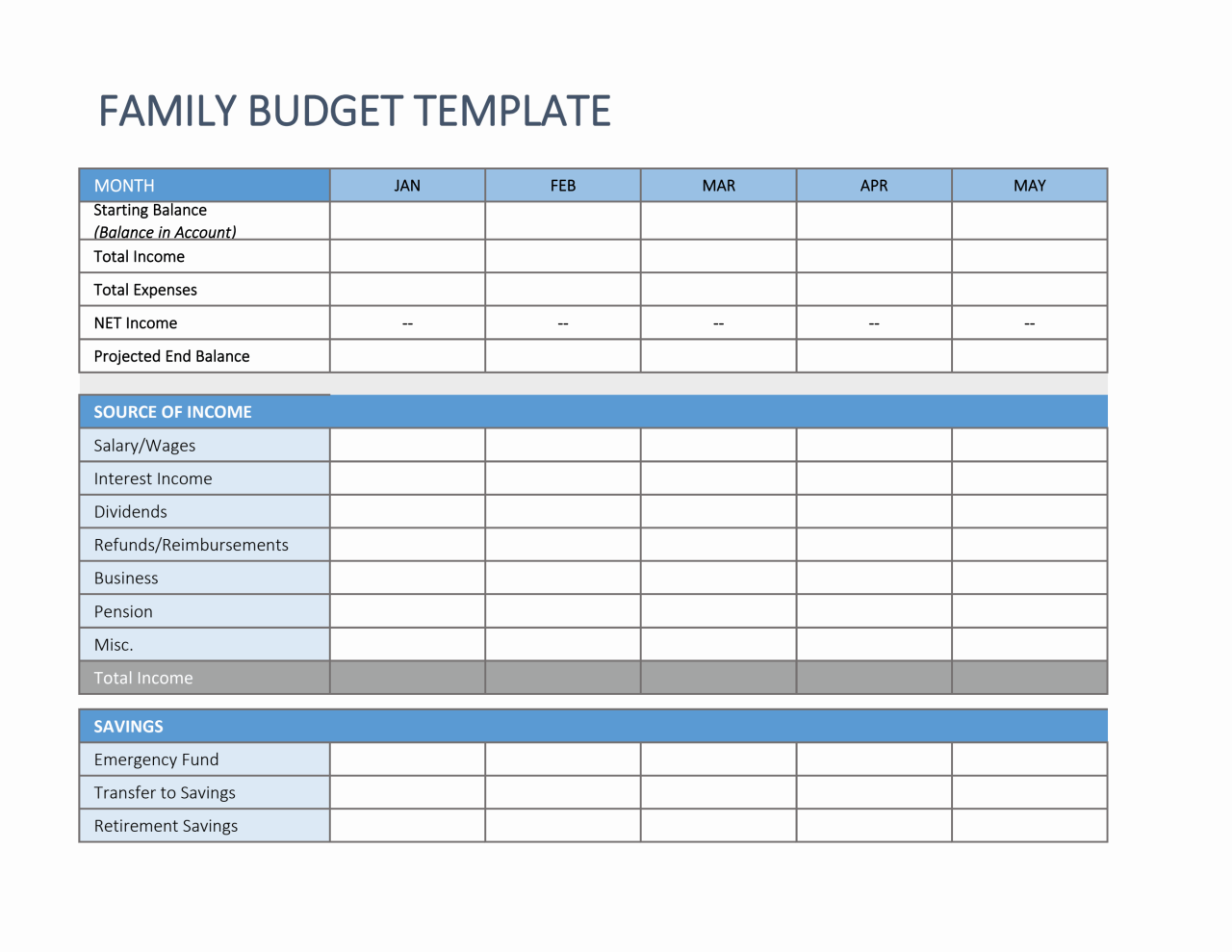

Steps to Create a Family Budget

- Calculate Total Income: Determine the total amount of money coming into the household each month from all sources.

- List Expenses: Make a detailed list of all monthly expenses, including bills, groceries, transportation, and other necessities.

- Set Financial Goals: Establish short-term and long-term financial goals that are achievable and specific to your family’s needs.

- Create a Budget Plan: Allocate a specific amount of money to each expense category based on your income and priorities.

- Track Spending: Monitor your spending regularly to ensure you are staying within your budget and adjust as needed.

Setting Realistic Financial Goals within a Family Budget

- Start Small: Begin by setting achievable goals that align with your family’s income and expenses to avoid frustration.

- Prioritize Needs: Focus on essential expenses like bills, groceries, and savings before allocating money to wants or non-essential items.

- Review and Adjust: Regularly review your financial goals and adjust them as needed based on changes in your family’s circumstances or priorities.

Different Budgeting Methods for Families

- Envelope System: Allocate cash into envelopes for different spending categories to ensure you stay within budget.

- 50/30/20 Rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt payments.

- Zero-Based Budgeting: Assign every dollar of income to a specific expense or savings category, leaving no money unallocated.

Tracking Expenses and Income

When it comes to managing a family budget, tracking expenses and income is crucial for financial stability and planning for the future. By keeping a close eye on where money is coming from and where it is going, families can make informed decisions to ensure they are living within their means and working towards their financial goals.

Importance of Tracking Expenses and Income

- Helps identify spending patterns and areas where money can be saved

- Allows for adjustments to be made in real-time to avoid overspending

- Provides a clear picture of the family’s financial health and progress towards goals

Tools and Techniques for Monitoring Expenses and Income, Budgeting for Families

- Use budgeting apps or software to categorize expenses and track income automatically

- Maintain a detailed spreadsheet to manually input expenses and income for a more hands-on approach

- Set up alerts or notifications for when spending in a certain category exceeds a predetermined limit

How Tracking Expenses Can Help Families Make Informed Financial Decisions

- By seeing where money is being spent, families can prioritize essential expenses and cut back on non-essential ones

- Identifying areas of overspending can lead to adjustments that free up funds for savings or debt repayment

- Having a clear understanding of income and expenses empowers families to set achievable financial goals and work towards them strategically

Saving and Investing within a Family Budget

Saving and investing are crucial components of a family budget as they help secure financial stability and build wealth for the future. By setting aside money for saving and making smart investment choices, families can work towards achieving their long-term financial goals.

Importance of Saving

- Building an emergency fund: Saving money for unexpected expenses like medical emergencies or home repairs can prevent families from going into debt.

- Planning for big purchases: Saving up for major expenses such as a new car or a family vacation can help avoid taking out loans with high interest rates.

- Retirement savings: Setting aside money for retirement is essential to ensure financial security in the later years of life.

Ways to Save and Invest Wisely

- Automate savings: Set up automatic transfers to a savings account each month to ensure consistent saving habits.

- Cut unnecessary expenses: Identify areas where you can reduce spending, such as dining out less frequently or canceling subscription services.

- Explore investment options: Consider investing in low-cost index funds, real estate, or retirement accounts like 401(k)s and IRAs for long-term growth.

Examples of Investment Options for Families

- 529 College Savings Plan: A tax-advantaged investment account specifically designed to save for a child’s education expenses.

- Health Savings Account (HSA): An account that allows families to save for medical expenses tax-free, providing a way to cover healthcare costs in the future.

- Real Estate Investment: Purchasing rental properties can generate passive income for families and build equity over time.