Credit Score Improvement takes center stage, inviting you into a world of financial empowerment. Dive into key strategies and pitfalls to enhance your credit standing.

Unveil the mystery behind credit scores and unlock the secrets to a brighter financial future.

Importance of Credit Score Improvement

Having a good credit score is crucial for financial health as it directly impacts your ability to borrow money at favorable terms.

Higher Credit Score, Better Interest Rates

A higher credit score can lead to better interest rates on loans, saving you money in the long run. Lenders see borrowers with high credit scores as less risky, thus offering lower interest rates.

Positive Impact on Eligibility for Credit Cards and Mortgages

A good credit score can positively impact your eligibility for credit cards and mortgages. It demonstrates your creditworthiness and financial responsibility, making you a more attractive borrower to lenders.

Factors Affecting Credit Score

When it comes to your credit score, there are several key factors that can have a significant impact on your overall score. Understanding these factors and how they contribute to your credit score is essential for improving and maintaining a healthy credit profile.

Payment History

Your payment history is one of the most important factors that influence your credit score. It accounts for about 35% of your total score. Late payments, defaults, and bankruptcies can have a negative impact on your score, while on-time payments can help boost your score. To improve your payment history, make sure to pay all your bills on time and in full.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount of credit available to you. This factor makes up about 30% of your credit score. Keeping your credit utilization ratio low, ideally below 30%, can positively impact your score. To improve your credit utilization, try to pay down your balances and avoid maxing out your credit cards.

Length of Credit History

The length of your credit history accounts for about 15% of your credit score. A longer credit history can be beneficial as it provides more data for lenders to assess your creditworthiness. To improve your credit history length, consider keeping older accounts open and active, even if you don’t use them frequently.

New Credit

Opening multiple new credit accounts in a short period of time can negatively impact your credit score. This factor makes up about 10% of your score. To improve your new credit factor, be cautious about opening new accounts and only apply for credit when necessary.

Credit Mix

Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact your credit score. This factor makes up about 10% of your score. To improve your credit mix, consider diversifying the types of credit you have and managing them responsibly.

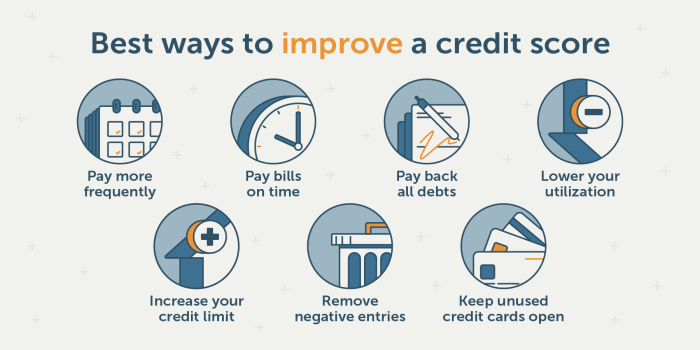

Strategies for Credit Score Improvement

Improving your credit score is crucial for financial stability and access to better opportunities. Here are some effective strategies to boost your credit score over time.

Paying Off Debt vs. Increasing Credit Limits

When it comes to improving your credit score, both paying off debt and increasing credit limits can be beneficial strategies. Paying off debt helps lower your credit utilization ratio, which is a key factor in determining your credit score. On the other hand, increasing your credit limits can also lower your credit utilization ratio if you maintain the same level of spending. However, it’s important to be cautious when increasing credit limits, as it may tempt you to overspend and accumulate more debt.

Step-by-Step Guide to Boosting Your Credit Score

- Check Your Credit Report: Start by reviewing your credit report to identify any errors or discrepancies that could be negatively affecting your score.

- Pay Bills on Time: Consistently paying your bills on time is one of the most important factors in determining your credit score.

- Reduce Credit Card Balances: Aim to keep your credit card balances low to improve your credit utilization ratio.

- Avoid Opening Too Many Accounts: Opening multiple new accounts in a short period of time can lower your average account age and negatively impact your credit score.

- Negotiate with Creditors: If you’re struggling to make payments, consider negotiating with your creditors to come up with a manageable repayment plan.

- Use Credit Wisely: Be mindful of how you use credit and only borrow what you can afford to repay to avoid accumulating excessive debt.

Common Mistakes to Avoid

When it comes to maintaining a healthy credit score, avoiding common mistakes is crucial. These mistakes can have a significant negative impact on your credit score and financial well-being. By being aware of these pitfalls and taking proactive steps to avoid them, you can ensure that your credit score remains strong and stable.

Missing Payments

- Missing credit card or loan payments can severely damage your credit score. Payment history is a key factor in determining your credit score, so it’s essential to make all payments on time.

- Avoid missing payments by setting up automatic payments or reminders to ensure you never forget a due date.

Maxing Out Credit Cards

- Maxing out your credit cards can indicate to lenders that you are heavily reliant on credit and may struggle with managing debt.

- Keep your credit card balances below 30% of your total credit limit to demonstrate responsible credit utilization.

Closing Old Accounts, Credit Score Improvement

- Closing old credit accounts can shorten your credit history and reduce the overall average age of your accounts, which can negatively impact your credit score.

- Consider keeping old accounts open, even if you’re not actively using them, to maintain a longer credit history.

Ignoring Errors on Credit Reports

- Errors on your credit report, such as inaccurate personal information or fraudulent accounts, can harm your credit score.

- Regularly monitor your credit report and dispute any errors or discrepancies to ensure your credit score is based on accurate information.