Customer Acquisition Cost sets the stage for understanding how businesses can thrive by minimizing expenses and maximizing returns. Dive into the world of CAC to uncover the secrets of successful growth strategies.

Definition of Customer Acquisition Cost

Customer Acquisition Cost (CAC) is the total amount of money a company spends on acquiring a new customer. It is a crucial metric for businesses as it helps determine the effectiveness of their marketing and sales strategies in attracting and retaining customers.

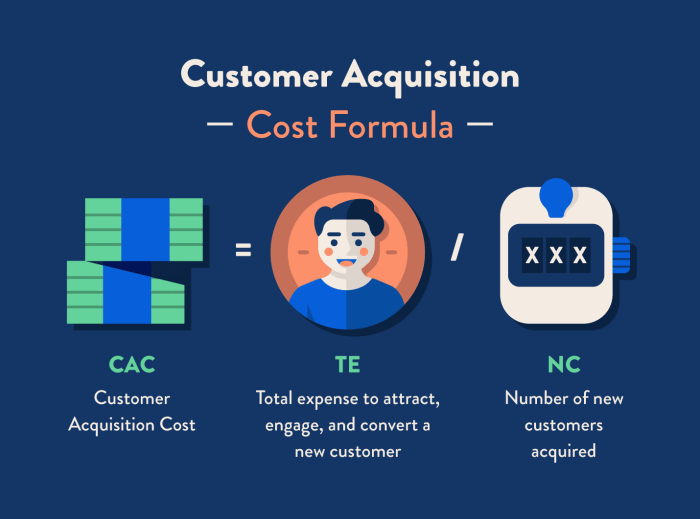

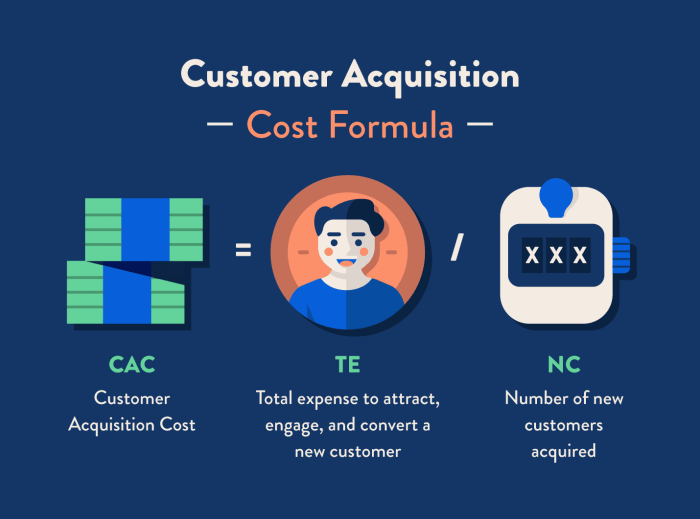

Calculation of CAC

- In the e-commerce industry, CAC is calculated by dividing the total marketing and sales expenses by the number of new customers acquired within a specific period.

- For subscription-based services, CAC is determined by dividing the total costs associated with acquiring and retaining customers by the number of new subscribers.

- In the SaaS (Software as a Service) sector, CAC can be calculated by dividing the total sales and marketing costs by the number of new customers gained through marketing efforts.

Significance of Optimizing CAC

- Understanding and optimizing CAC is essential for a company’s growth as it directly impacts profitability and sustainability.

- By reducing CAC through efficient marketing strategies or enhancing customer retention, businesses can increase their return on investment and expand their customer base.

- Optimizing CAC helps companies allocate resources effectively, identify areas for improvement, and enhance overall business performance.

Factors Influencing Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), there are several factors that can greatly influence how much a company spends to acquire a new customer. Understanding these factors is essential for businesses to optimize their marketing strategies and improve their bottom line.

Marketing Channels

The choice of marketing channels can have a significant impact on CAC. Different channels have varying costs associated with them, and some may be more effective at reaching the target audience than others. For example, digital marketing channels like social media advertising or Google AdWords can be cost-effective for reaching a large audience, while traditional channels like print ads or TV commercials may be more expensive but still effective for certain demographics.

Target Audience

Understanding the target audience is crucial in determining CAC. If a company is targeting a highly competitive market with a niche product, the cost of acquiring customers may be higher due to the need for more targeted and personalized marketing strategies. On the other hand, targeting a less competitive market with a broad appeal product can lead to lower CAC as it may be easier to reach and convert customers.

Product Pricing

The pricing of a product or service can also impact CAC. If a company offers a high-priced product, the cost of acquiring customers may be higher as more effort and resources are needed to convince customers to make a larger purchase. Conversely, a lower-priced product may result in lower CAC as it may be easier to attract customers with a lower barrier to entry.

Competition

The level of competition in the market can influence CAC as well. In highly competitive industries, companies may need to spend more on marketing and advertising to stand out from competitors and attract customers. This can drive up CAC. On the other hand, in less competitive markets, companies may be able to acquire customers at a lower cost due to less competition for their target audience.

Strategies to Lower Customer Acquisition Cost

In order to reduce Customer Acquisition Cost (CAC), companies can implement various strategies that focus on optimizing their marketing efforts and improving customer retention.

Optimizing Marketing Channels

One effective tactic to lower CAC is to identify the most cost-effective marketing channels and concentrate efforts on them. By analyzing data and performance metrics, companies can allocate resources to channels that yield the highest return on investment. This targeted approach can help reduce overall acquisition costs.

Enhancing Customer Retention

Customer retention plays a crucial role in lowering CAC. By focusing on providing exceptional customer service, personalized experiences, and loyalty programs, companies can increase customer lifetime value and reduce the need for constant acquisition of new customers. Retaining existing customers is often more cost-effective than acquiring new ones.

Case Study: Amazon Prime

A prime example of successful CAC reduction through customer retention is Amazon Prime. By offering a subscription service with numerous benefits such as free shipping, exclusive deals, and streaming services, Amazon has been able to retain a large customer base. This has not only increased customer loyalty but also reduced the need for expensive acquisition campaigns.

Utilizing Referral Programs, Customer Acquisition Cost

Implementing referral programs can also be an effective strategy to lower CAC. By incentivizing existing customers to refer new ones, companies can acquire customers at a lower cost. Referral programs leverage word-of-mouth marketing and tap into existing networks, resulting in higher-quality leads and lower acquisition expenses.

Calculating Customer Acquisition Cost

Calculating Customer Acquisition Cost (CAC) is crucial for businesses to understand how much they are spending to acquire each new customer. There are different methods to calculate CAC, each providing valuable insights into the effectiveness of marketing strategies.

Different Methods to Calculate CAC

There are several methods to calculate Customer Acquisition Cost, including:

- Simple CAC Formula: CAC = Total Sales and Marketing Costs / Number of New Customers Acquired

- CAC Ratio: CAC = Marketing Costs / Number of Customers Acquired

- Cohort-Based CAC Calculation: CAC = Total Costs Incurred During a Specific Time Period / Number of Customers Acquired in that Period

Step-by-Step Guidance on Calculating CAC with Examples

Let’s take an example to calculate CAC using the Simple CAC Formula:

- Calculate Total Sales and Marketing Costs for a specific period, let’s say $10,000.

- Count the Number of New Customers Acquired in the same period, let’s say 100.

- Apply the formula: CAC = $10,000 / 100 = $100

Importance of Accurate CAC Calculations

Accurate CAC calculations are essential for making informed business decisions such as setting marketing budgets, evaluating the effectiveness of marketing campaigns, and determining the profitability of acquiring new customers. Without accurate CAC calculations, businesses may overspend on acquiring customers or underestimate the true cost of customer acquisition.