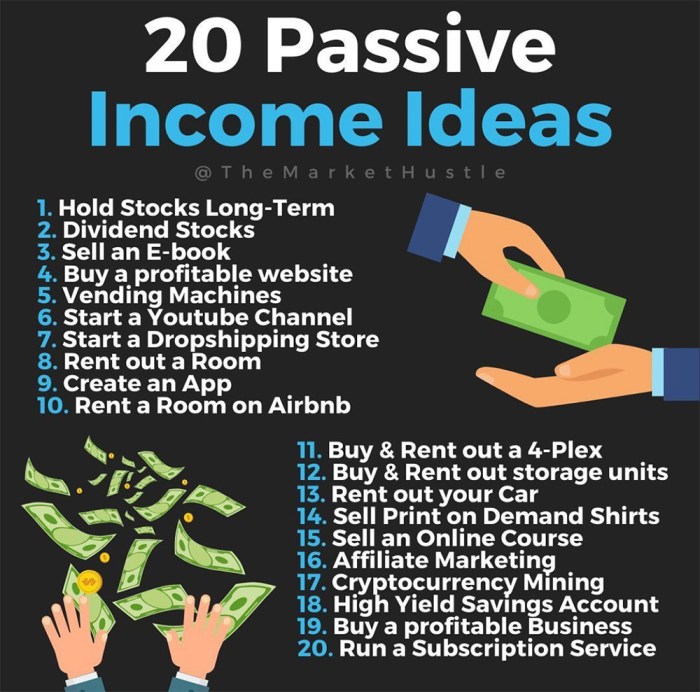

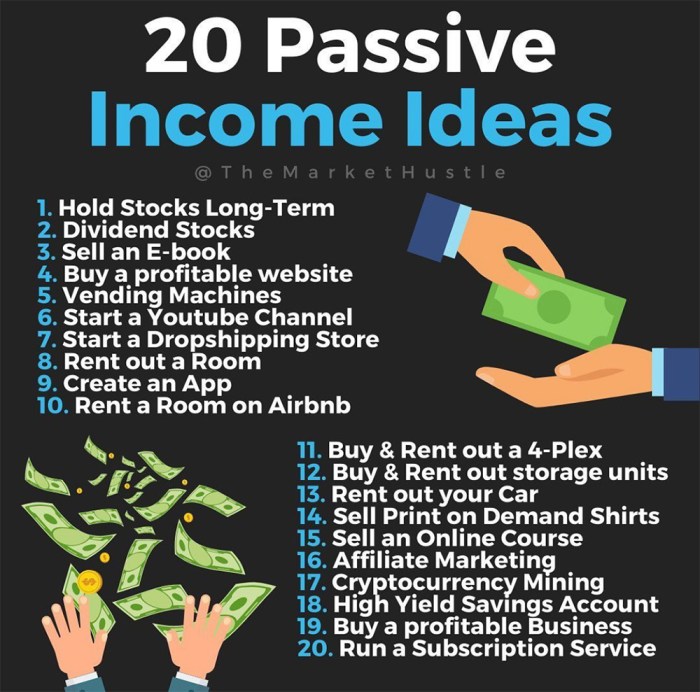

Passive Income Ideas sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

If you’re ready to explore various avenues for generating passive income, buckle up as we dive into the world of financial independence and smart investment strategies.

Introduction to Passive Income Ideas

Passive income is like making money in your sleep, yo! It’s the cash flow you earn without actively working for it, allowing you to have more freedom and flexibility in your life.

Unlike active income where you hustle for every dollar, passive income keeps rolling in even when you’re chilling on the beach. That’s why it’s the dream for many peeps looking to escape the 9-5 grind.

Examples of Popular Passive Income Streams, Passive Income Ideas

- Investing in dividend-paying stocks: You buy shares in companies that pay dividends, and you get paid regularly just for owning those stocks, straight up!

- Rental properties: Buy a crib, rent it out, and watch the rent money flow into your account every month while you sip on that margarita, no cap.

- Creating digital products: Write an e-book, record a course, or design a dope app once, and keep making money on the reg with each download or purchase. That’s the hustle!

Real Estate Investments

Investing in real estate is a popular way to generate passive income. By owning properties, you can earn money through rental income, property appreciation, and other real estate investment strategies.

Rental Properties

- Owning rental properties involves purchasing homes, apartments, or commercial spaces and renting them out to tenants.

- Pros:

- Steady rental income

- Potential property appreciation

- Tax benefits such as deductions for mortgage interest and property depreciation

- Cons:

- Property management responsibilities

- Risk of vacancies and bad tenants

- Initial investment and ongoing maintenance costs

Real Estate Crowdfunding

- Real estate crowdfunding allows investors to pool their money together to invest in properties without directly owning them.

- Pros:

- Diversification by investing in multiple properties

- Lower upfront costs compared to buying properties outright

- Passive income without property management responsibilities

- Cons:

- Lack of control over property management decisions

- Potential lower returns compared to owning properties directly

- Risk of platform or property failures

Online Business Ventures: Passive Income Ideas

When it comes to generating passive income through online business ventures, the possibilities are endless. By leveraging the power of the internet, individuals can create sustainable sources of income that require minimal ongoing effort.

One key factor in successful online business ventures is scalability. This involves setting up systems and processes that can easily accommodate growth without requiring significant additional resources. Automation is another essential component, as it allows for tasks to be completed without constant manual intervention.

Dropshipping

Dropshipping is a popular online business model where the seller does not keep products in stock. Instead, when a product is sold, the seller purchases the item from a third party and has it shipped directly to the customer. This eliminates the need for inventory management and upfront investment in stock.

Affiliate Marketing

Affiliate marketing involves promoting products or services from other companies and earning a commission for each sale made through your referral. This can be a lucrative passive income stream once you have built a strong online presence and a loyal audience.

Print on Demand

Print on demand allows individuals to create and sell custom-designed products without the need to hold inventory or manage production. When a customer makes a purchase, the product is printed and shipped directly from the print provider. This business model offers low upfront costs and minimal risk.

Stock Market and Dividends

Investing in dividend-paying stocks is a popular strategy for generating passive income. When you own shares of a company that pays dividends, you receive a portion of the company’s profits on a regular basis, typically quarterly. This can provide a steady stream of income without requiring active involvement in the company’s operations.

Dividend Reinvestment Plans (DRIPs)

Dividend reinvestment plans (DRIPs) allow investors to automatically reinvest their dividends back into buying more shares of the same company. This strategy can lead to the compounding of returns over time, as the reinvested dividends generate more dividends of their own. DRIPs are particularly beneficial for long-term passive income growth, as they can accelerate the growth of your investment portfolio without any additional effort on your part.

Dividend Stocks vs Growth Stocks

Dividend stocks and growth stocks are two common types of investments in the stock market. Dividend stocks provide regular income through dividend payments, while growth stocks focus on capital appreciation through an increase in stock price. For passive income investors, dividend stocks are often preferred due to the consistent income stream they offer. However, growth stocks can also be valuable for long-term wealth accumulation, as they have the potential for significant capital gains. It’s essential to balance your investment portfolio with a mix of both dividend and growth stocks to diversify risk and maximize returns.

Affiliate Marketing

Affiliate marketing is a business model where individuals earn a commission by promoting other companies’ products or services. This can be a lucrative source of passive income as you earn money for each sale or lead that is generated through your unique affiliate link.

Tips for Success in Affiliate Marketing

- Choose products or services that align with your interests or expertise to make promotion more authentic.

- Focus on building trust with your audience by providing valuable content and honest recommendations.

- Diversify your affiliate partnerships to maximize income potential and reduce reliance on one source.

- Track and analyze your performance to optimize your strategies and focus on what works best.

- Stay updated on industry trends and adjust your marketing tactics accordingly to stay competitive.

Examples of Affiliate Programs in Different Niches

| Niche | Affiliate Program |

|---|---|

| Fitness | Amazon Associates – Earn commission on fitness equipment, supplements, and apparel. |

| Technology | ClickBank – Promote digital products like software and gadgets for commissions. |

| Travel | Booking.com – Get paid for referring hotel bookings and travel packages. |

| Finance | Robinhood Affiliate Program – Earn money for each user who signs up for the trading platform. |